Hi Everyone,

I am back with some random things again. So today i will share codes of popular trading indicators which you can use while creating your own trader with machine learning in python.

so at first you need to import the below libraries

import numpy as np

import pandas as pd

from pandas_datareader import data as web

import matplotlib.pyplot as plt

then after the above step is done then you need to assign few of the local variables you can also take them as input as per your requirement

stock_name="SBI" #for nifty: ^NSEI

n = 20 #window size

start_date = "2021-04-01"

end_date = "2021-06-03"

then after it is done you need to create a function which can be used to extract the data from the yahoo finance and for that the code is provided below

def getData():

stock_data = web.DataReader(stock_name, start=start_date, end=end_date, data_source='yahoo')

stock_df=pd.DataFrame(stock_data)

return stock_df

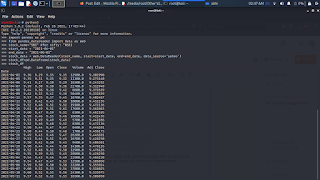

The above code will return data having below symbols

Symbols:-

'High', 'Low', 'Open', 'Close', 'Volume', 'Adj Close', 'MA_20',

'EMA_20', 'Momentum_20', 'ROC_20', 'ATR_20', 'BollingerB_20',

'Bollinger%b_20', 'PP', 'R1', 'S1', 'R2', 'S2', 'R3', 'S3', 'SO%k',

'SO%d_20', 'Trix_20', 'Mass Index', 'Vortex_20', 'RSI_20', 'Chaikin',

'MFI_20', 'OBV_20', 'Force_20', 'EoM_20', 'CCI_20', 'Copp_20',

'KelChM_20', 'KelChU_20', 'KelChD_20', 'Ultimate_Osc', 'Donchian_20',

'STD_20'

df1 = getData()

After all the above steps are done you can move forward with indicators function. Use can use multiple indicators or single as per your needs.

1-> Exponential Moving Average:-

def exponential_moving_average(df, n):

EMA = pd.Series(df['Close'].ewm(span=n, min_periods=n).mean(), name='EMA_' + str(n))

df = df.join(EMA)

return df

2-> Moving Average:-

def moving_average(df, n):

MA = pd.Series(df['Close'].rolling(n, min_periods=n).mean(), name='MA_' + str(n))

df = df.join(MA)

return df

3-> Momentum:-

def momentum(df, n):

M = pd.Series(df['Close'].diff(n), name='Momentum_' + str(n))

df = df.join(M)

return df

4-> Rate of change:-

def rate_of_change(df, n):

M = df['Close'].diff(n - 1)

N = df['Close'].shift(n - 1)

ROC = pd.Series(M / N, name='ROC_' + str(n))

df = df.join(ROC)

return df

5-> Average True Range:-

def average_true_range(df, n):

i = 0

TR_l = [0]

while i < df.shape[0]-2: #df.index[-1]:

TR = max(df['High'][i +1], df['Close'][i]) - min(df['Low'][i + 1], df['Close'][i])

TR_l.append(TR)

i = i + 1

TR_s = pd.Series(TR_l)

ATR = pd.Series(TR_s.ewm(span=n, min_periods=n).mean(), name='ATR_' + str(n))

df = df.join(ATR)

return df

6-> Bollinger Bands:-

def bollinger_bands(df, n):

MA = pd.Series(df['Close'].rolling(n, min_periods=n).mean())

MSD = pd.Series(df['Close'].rolling(n, min_periods=n).std())

b1 = 4 * MSD / MA

B1 = pd.Series(b1, name='BollingerB_' + str(n))

df = df.join(B1)

b2 = (df['Close'] - MA + 2 * MSD) / (4 * MSD)

B2 = pd.Series(b2, name='Bollingerb_' + str(n))

df = df.join(B2)

return df

7-> PPSR:-

def ppsr(df):

"""Calculate Pivot Points, Supports and Resistances for given data"""

PP = pd.Series((df['High'] + df['Low'] + df['Close']) / 3)

R1 = pd.Series(2 * PP - df['Low'])

S1 = pd.Series(2 * PP - df['High'])

R2 = pd.Series(PP + df['High'] - df['Low'])

S2 = pd.Series(PP - df['High'] + df['Low'])

R3 = pd.Series(df['High'] + 2 * (PP - df['Low']))

S3 = pd.Series(df['Low'] - 2 * (df['High'] - PP))

psr = {'PP': PP, 'R1': R1, 'S1': S1, 'R2': R2, 'S2': S2, 'R3': R3, 'S3': S3}

PSR = pd.DataFrame(psr)

df = df.join(PSR)

return df

8-> Stochastic Oscillator:-

def stochastic_oscillator_k(df):

SOk = pd.Series((df['Close'] - df['Low']) / (df['High'] - df['Low']), name='SO%k')

df = df.join(SOk)

return df

9-> Stochastic Oscillator:-

def stochastic_oscillator_d(df, n):

SOk = pd.Series((df['Close'] - df['Low']) / (df['High'] - df['Low']), name='SO%k')

SOd = pd.Series(SOk.ewm(span=n, min_periods=n).mean(), name='SO%d_' + str(n))

df = df.join(SOd)

return df

10-> Trix:-

def trix(df, n):

EX1 = df['Close'].ewm(span=n, min_periods=n).mean()

EX2 = EX1.ewm(span=n, min_periods=n).mean()

EX3 = EX2.ewm(span=n, min_periods=n).mean()

i = 0

ROC_l = [np.nan]

while i + 1 <= df.shape[0]-1:

ROC = (EX3[i + 1] - EX3[i]) / EX3[i]

ROC_l.append(ROC)

i = i + 1

Trix = pd.Series(ROC_l, name='Trix_' + str(n))

df = df.join(Trix)

return df

11-> Average Directional Movement Index:-

def average_directional_movement_index(df, n, n_ADX):

i = 0

UpI = []

DoI = []

while i + 1 <= df.index[-1]:

UpMove = df.loc[i + 1, 'High'] - df.loc[i, 'High']

DoMove = df.loc[i, 'Low'] - df.loc[i + 1, 'Low']

if UpMove > DoMove and UpMove > 0:

UpD = UpMove

else:

UpD = 0

UpI.append(UpD)

if DoMove > UpMove and DoMove > 0:

DoD = DoMove

else:

DoD = 0

DoI.append(DoD)

i = i + 1

i = 0

TR_l = [0]

while i < df.index[-1]:

TR = max(df.loc[i + 1, 'High'], df.loc[i, 'Close']) - min(df.loc[i + 1, 'Low'], df.loc[i, 'Close'])

TR_l.append(TR)

i = i + 1

TR_s = pd.Series(TR_l)

ATR = pd.Series(TR_s.ewm(span=n, min_periods=n).mean())

UpI = pd.Series(UpI)

DoI = pd.Series(DoI)

PosDI = pd.Series(UpI.ewm(span=n, min_periods=n).mean() / ATR)

NegDI = pd.Series(DoI.ewm(span=n, min_periods=n).mean() / ATR)

ADX = pd.Series((abs(PosDI - NegDI) / (PosDI + NegDI)).ewm(span=n_ADX, min_periods=n_ADX).mean(),

name='ADX_' + str(n) + '_' + str(n_ADX))

df = df.join(ADX)

return df

12-> MACD:-

def macd(df, n_fast, n_slow):

EMAfast = pd.Series(df['Close'].ewm(span=n_fast, min_periods=n_slow).mean())

EMAslow = pd.Series(df['Close'].ewm(span=n_slow, min_periods=n_slow).mean())

MACD = pd.Series(EMAfast - EMAslow, name='MACD_' + str(n_fast) + '_' + str(n_slow))

MACDsign = pd.Series(MACD.ewm(span=9, min_periods=9).mean(), name='MACDsign_' + str(n_fast) + '_' + str(n_slow))

MACDdiff = pd.Series(MACD - MACDsign, name='MACDdiff_' + str(n_fast) + '_' + str(n_slow))

df = df.join(MACD)

df = df.join(MACDsign)

df = df.join(MACDdiff)

return df

13-> Mass Index:-

def mass_index(df):

Range = df['High'] - df['Low']

EX1 = Range.ewm(span=9, min_periods=9).mean()

EX2 = EX1.ewm(span=9, min_periods=9).mean()

Mass = EX1 / EX2

MassI = pd.Series(Mass.rolling(25).sum(), name='Mass Index')

df = df.join(MassI)

return df

14-> Vortex Indicator:-

def vortex_indicator(df, n):

i = 0

TR = [0]

while i < df.shape[0]-1:

Range = max(df['High'][i + 1], df['Close'][i]) - min(df['Low'][i + 1], df['Close'][i])

TR.append(Range)

i = i + 1

i = 0

VM = [0]

while i < df.shape[0]-1:

Range = abs(df['High'][i + 1] - df['Low'][i]) - abs(df['Low'][i + 1] - df['High'][i])

VM.append(Range)

i = i + 1

VI = pd.Series(pd.Series(VM).rolling(n).sum() / pd.Series(TR).rolling(n).sum(), name='Vortex_' + str(n))

df = df.join(VI)

return df

15-> KST Oscillator:-

def kst_oscillator(df, r1, r2, r3, r4, n1, n2, n3, n4):

M = df['Close'].diff(r1 - 1)

N = df['Close'].shift(r1 - 1)

ROC1 = M / N

M = df['Close'].diff(r2 - 1)

N = df['Close'].shift(r2 - 1)

ROC2 = M / N

M = df['Close'].diff(r3 - 1)

N = df['Close'].shift(r3 - 1)

ROC3 = M / N

M = df['Close'].diff(r4 - 1)

N = df['Close'].shift(r4 - 1)

ROC4 = M / N

KST = pd.Series(

ROC1.rolling(n1).sum() + ROC2.rolling(n2).sum() * 2 + ROC3.rolling(n3).sum() * 3 + ROC4.rolling(n4).sum() * 4,

name='KST_' + str(r1) + '_' + str(r2) + '_' + str(r3) + '_' + str(r4) + '_' + str(n1) + '_' + str(

n2) + '_' + str(n3) + '_' + str(n4))

df = df.join(KST)

return df

16-> Relative Strength Index:-

def relative_strength_index(df, n):

i = 0

UpI = [0]

DoI = [0]

while i + 1 <= df.shape[0]-1:

UpMove = df['High'][i + 1] - df['High'][i]

DoMove = df['Low'][i] - df['Low'][i + 1]

if UpMove > DoMove and UpMove > 0:

UpD = UpMove

else:

UpD = 0

UpI.append(UpD)

if DoMove > UpMove and DoMove > 0:

DoD = DoMove

else:

DoD = 0

DoI.append(DoD)

i = i + 1

UpI = pd.Series(UpI)

DoI = pd.Series(DoI)

PosDI = pd.Series(UpI.ewm(span=n, min_periods=n).mean())

NegDI = pd.Series(DoI.ewm(span=n, min_periods=n).mean())

RSI = pd.Series(PosDI / (PosDI + NegDI), name='RSI_' + str(n))

df = df.join(RSI)

return df

17-> True Strength Index:-

def true_strength_index(df, r, s):

M = pd.Series(df['Close'].diff(1))

aM = abs(M)

EMA1 = pd.Series(M.ewm(span=r, min_periods=r).mean())

aEMA1 = pd.Series(aM.ewm(span=r, min_periods=r).mean())

EMA2 = pd.Series(EMA1.ewm(span=s, min_periods=s).mean())

aEMA2 = pd.Series(aEMA1.ewm(span=s, min_periods=s).mean())

TSI = pd.Series(EMA2 / aEMA2, name='TSI_' + str(r) + '_' + str(s))

df = df.join(TSI)

return df

18-> Accumulation Distribution:-

def accumulation_distribution(df, n):

ad = (2 * df['Close'] - df['High'] - df['Low']) / (df['High'] - df['Low']) * df['Volume']

M = ad.diff(n - 1)

N = ad.shift(n - 1)

ROC = M / N

AD = pd.Series(ROC, name='Acc/Dist_ROC_' + str(n))

df = df.join(AD)

return df

19-> Chaikin Oscillator:-

def chaikin_oscillator(df):

ad = (2 * df['Close'] - df['High'] - df['Low']) / (df['High'] - df['Low']) * df['Volume']

Chaikin = pd.Series(ad.ewm(span=3, min_periods=3).mean() - ad.ewm(span=10, min_periods=10).mean(), name='Chaikin')

df = df.join(Chaikin)

return df

20-> Money Flow Index:-

def money_flow_index(df, n):

PP = (df['High'] + df['Low'] + df['Close']) / 3

i = 0

PosMF = [0]

while i < df.shape[0]-1:

if PP[i + 1] > PP[i]:

PosMF.append(PP[i + 1] * df['Volume'][i + 1])

else:

PosMF.append(0)

i = i + 1

PosMF = pd.Series(PosMF)

TotMF = PP * df['Volume']

MFR = pd.Series(PosMF / TotMF)

MFI = pd.Series(MFR.rolling(n, min_periods=n).mean(), name='MFI_' + str(n))

df = df.join(MFI)

return df

21-> On Balance Volume:-

def on_balance_volume(df, n):

i = 0

OBV = [0]

while i < df.shape[0]-1:

if df['Close'][i + 1] - df['Close'][i] > 0:

OBV.append(df['Volume'][i + 1])

if df['Close'][i + 1] - df['Close'][i] == 0:

OBV.append(0)

if df['Close'][i + 1] - df['Close'][i] < 0:

OBV.append(-df['Volume'][i + 1])

i = i + 1

OBV = pd.Series(OBV)

OBV_ma = pd.Series(OBV.rolling(n, min_periods=n).mean(), name='OBV_' + str(n))

df = df.join(OBV_ma)

return df

22-> Force Index:-

def force_index(df, n):

F = pd.Series(df['Close'].diff(n) * df['Volume'].diff(n), name='Force_' + str(n))

df = df.join(F)

return df

23-> Ease of Movement:-

def ease_of_movement(df, n):

EoM = (df['High'].diff(1) + df['Low'].diff(1)) * (df['High'] - df['Low']) / (2 * df['Volume'])

Eom_ma = pd.Series(EoM.rolling(n, min_periods=n).mean(), name='EoM_' + str(n))

df = df.join(Eom_ma)

return df

24-> Commodity Channel Index:-

def commodity_channel_index(df, n):

PP = (df['High'] + df['Low'] + df['Close']) / 3

CCI = pd.Series((PP - PP.rolling(n, min_periods=n).mean()) / PP.rolling(n, min_periods=n).std(),

name='CCI_' + str(n))

df = df.join(CCI)

return df

25-> Coppock Curve:-

def coppock_curve(df, n):

M = df['Close'].diff(int(n * 11 / 10) - 1)

N = df['Close'].shift(int(n * 11 / 10) - 1)

ROC1 = M / N

M = df['Close'].diff(int(n * 14 / 10) - 1)

N = df['Close'].shift(int(n * 14 / 10) - 1)

ROC2 = M / N

Copp = pd.Series((ROC1 + ROC2).ewm(span=n, min_periods=n).mean(), name='Copp_' + str(n))

df = df.join(Copp)

return df

26-> Keltner Channel:-

def keltner_channel(df, n):

KelChM = pd.Series(((df['High'] + df['Low'] + df['Close']) / 3).rolling(n, min_periods=n).mean(),

name='KelChM_' + str(n))

KelChU = pd.Series(((4 * df['High'] - 2 * df['Low'] + df['Close']) / 3).rolling(n, min_periods=n).mean(),

name='KelChU_' + str(n))

KelChD = pd.Series(((-2 * df['High'] + 4 * df['Low'] + df['Close']) / 3).rolling(n, min_periods=n).mean(),

name='KelChD_' + str(n))

df = df.join(KelChM)

df = df.join(KelChU)

df = df.join(KelChD)

return df

27-> Ultimate Oscillator:-

def ultimate_oscillator(df):

i = 0

TR_l = [0]

BP_l = [0]

while i < df.shape[0]-1:

TR = max(df['High'][i + 1], df['Close'][i]) - min(df['Low'][i + 1], df['Close'][i])

TR_l.append(TR)

BP = df['Low'][i + 1] - min(df['Low'][i + 1], df['Close'][i])

BP_l.append(BP)

i = i + 1

UltO = pd.Series((4 * pd.Series(BP_l).rolling(7).sum() / pd.Series(TR_l).rolling(7).sum()) + (

2 * pd.Series(BP_l).rolling(14).sum() / pd.Series(TR_l).rolling(14).sum()) + (

pd.Series(BP_l).rolling(28).sum() / pd.Series(TR_l).rolling(28).sum()),

name='Ultimate_Osc')

df = df.join(UltO)

return df

28-> Donchin Channel:-

def donchian_channel(df, n):

i = 0

dc_l = []

while i < n - 1:

dc_l.append(0)

i += 1

i = 0

while i + n - 1 < df.shape[0]:

dc = max(df['High'][i:i + n - 1]) - min(df['Low'][i:i + n - 1])

dc_l.append(dc)

i += 1

donchian_chan = pd.Series(dc_l, name='Donchian_' + str(n))

donchian_chan = donchian_chan.shift(n - 1)

return df.join(donchian_chan)

29-> Standard Deviations:-

def standard_deviation(df, n):

df = df.join(pd.Series(df['Close'].rolling(n, min_periods=n).std(), name='STD_' + str(n)))

return df

When you have decided that which strategy(Single or multiple indicators totally on your wish) you want to use then you can call the function like below

df = standard_deviation(df, n)

It will store the result in the dataframe with an increased column.

you can fill NA value in dataframes through this formula

df=df.fillna(method='ffill')

ffill for forward fill & bfill for backward. ffill is quite favorable as if bffill is done then data can become biased.

To store the data in csv format

df.to_csv('trade.csv', index=False)

For plotting graph use matplotlib & you can also share the code in case you have succesfully implemented the code with learning module.

Comments

Post a Comment